- Personal finance software offers entrepreneurs a comprehensive overview of their income, expenses, and savings. By accurately tracking financial data, it allows users to create budgets and set financial goals effectively. Many tools in this category offer customizable settings that can adapt to your unique business needs, ensuring you stay on top of your finances and plan for a secure future.

- A budgeting planner is a must-have for any entrepreneur looking to maintain financial stability. This tool provides a structured way to plan expenses and monitor cash flow. Many planners include helpful tips and templates for setting financial goals, making them an excellent gift that empowers entrepreneurs to take control of their finances.

Business Planner Undated for Entrepreneurs! Focus Project Notebook for Productivity! Daily Weekly Self Organizer Planner / Win the Day! Beat Procrastination! Ifocus - A5 work planner

$29.97

Daily, Weekly & Monthly Planner | Quarterly Business Planner for Business Owners | 90-Day Goal, Productivity & Organizer System | Plan, Execute & Reflect with Clarity for Growth

$39.99

- Managing debt is a critical aspect of financial planning. A debt repayment calculator helps entrepreneurs visualize how long it will take to pay off debts based on their specific payments. This tool helps craft better financial strategies, reducing stress and allowing business owners to focus on growth.

Casio HR-10RC Mini Desktop Printing Calculator | Portable | 12-Digit Display | One-Color Printer | Tax & Currency | Ideal for Taxes, Bookkeeping & Accounting Tasks

$26.63

Calculated Industries 3415 Qualifier Plus IIIx Advanced Real Estate Mortgage Finance Calculator | Simple Operation | Buyer Pre-Qualifying | Solves Payments, Amortization, ARMs, Combos, FHA, VA, More

$43.00

- Financial forecasting templates are essential for entrepreneurs who want to predict future revenues and expenses. These templates help in developing a proactive financial strategy, enabling business owners to navigate uncertainties. By utilizing these tools, entrepreneurs can make data-driven decisions and set milestones for growth and success.

- Investment tracking software allows entrepreneurs to monitor their investments effectively. It enables users to assess performance, analyze trends, and make informed investment choices. Entrepreneurs can benefit greatly from these tools, ensuring their assets work toward securing their future financial goals.

Day Trading QuickStart Guide: The Simplified Beginner's Guide to Winning Trade Plans, Conquering the Markets, and Becoming a Successful Day Trader (Trading & Investing - QuickStart Guides)

5 formats

A Revolution in Construction Estimating: Achieve accurate and profitable results using new strategies and software to win jobs, dominate the competition and build a money making machine.

3 formats

- An expense tracker app enables entrepreneurs to keep tabs on their daily spending habits. With features such as categorization and real-time updates, these apps foster greater financial discipline and help business owners identify areas for cost-saving, ultimately contributing to their financial well-being.

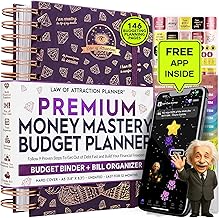

Budget Planner and Monthly Bill Organizer + Cash Envelope Buget Sytem | Finance Planner, Bill Payment Tracker & Money Saving with Panduo App | Money Mindset Journal for Attracting Financial Abundance

$24.95

Budget Planner and Monthly Bill Organizer + Cash Envelope Buget Sytem | Finance Planner, Bill Payment Tracker & Money Saving with Panduo App | Money Mindset Journal for Attracting Financial Abundance

$24.95

- A thorough retirement planning guide is an invaluable resource for entrepreneurs. These guides typically cover various strategies for accumulating retirement savings, including taxes and investment options. By educating themselves through these resources, entrepreneurs can ensure a secure and comfortable future.

The Ultimate Retirement Guide for 50+: Winning Strategies to Make Your Money Last a Lifetime (Revised & Updated for 2025)

5 formats

The Only Living Trusts Book You’ll Ever Need: How to Make Your Own Living Trust, Avoid Probate & Protect Your Heirs (Plus Protect Your Assets & Save Thousands on Taxes) (Wealth Strategy) The Only Living Trusts Book You’ll Ever Need: How to Make Your Own Living Trust, Avoid Probate & Protect Your Heir…

The Only Living Trusts Book You’ll Ever Need: How to Make Your Own Living Trust, Avoid Probate & Protect Your Heirs (Plus Protect Your Assets & Save Thousands on Taxes) (Wealth Strategy)

- Effective cash flow management is crucial for business survival, and a dedicated tool can simplify this process for entrepreneurs. These tools allow for real-time cash flow tracking, forecasting, and analysis, empowering business owners to manage their finances more efficiently and predict challenges before they arise.

THE MODERN PLAYBOOK FOR SPONSORSHIP & CASH FLOW: How To Leverage Social Media & Digital Strategies to Land Deals, Build Your Brand & Fund Your Racing, Riding & Driving Without Needing Pro-Level Talent

$39.95

Accounting QuickStart Guide: The Simplified Beginner's Guide to Financial & Managerial Accounting For Students, Business Owners and Finance Professionals (Starting a Business - QuickStart Guides)

$18.61

- Online financial coaching services provide personalized financial advice tailored to entrepreneurs. These services help business owners address their unique challenges, create actionable financial strategies, and ultimately secure their financial future. Investing in professional guidance is one of the best gifts an entrepreneur can give themselves.

- A business credit card comparison tool allows entrepreneurs to evaluate different credit card options based on their individual needs. By choosing the right card, entrepreneurs can maximize rewards while minimizing costs, contributing to their overall financial strategy and future security.

Frequently Asked Questions

Why should I invest in financial planning tools as an entrepreneur?

Investing in financial planning tools helps you manage your business finances systematically, ensuring better decision-making and helping you secure a stable financial future.

Are there free options available for budgeting and finance management?

Yes, there are several free options available like GnuCash and Tiller Money, which allow entrepreneurs to manage their finances without incurring high costs.

What features should I look for in financial planning tools?

Key features to look for include budgeting, expense tracking, invoicing, financial reporting, and tax preparation capabilities. Depending on your business needs, prioritize tools that offer those functionalities.

Can these tools help in retirement planning?

Yes, many financial planning tools like Personal Capital include features that help you monitor your overall wealth and plan for retirement.

Do I need an accounting background to use these tools?

Most of these tools are designed to be user-friendly and do not require an accounting background. They often provide guidance and support to help users navigate the software.

What financial planning tools are essential for entrepreneurs?

Essential financial planning tools for entrepreneurs include personal finance software, budgeting planners, and investment tracking tools. These resources help business owners manage their finances effectively, set goals, and plan for future sustainability.

How can financial planning tools help secure my future as an entrepreneur?

Financial planning tools equip entrepreneurs with insights into their financial status, providing the ability to create budgets, forecast revenues, and manage cash flow. By utilizing these tools, business owners can make informed decisions and plan strategically for future growth.

Are there free financial planning tools available for entrepreneurs?

Yes, many free financial planning tools are available, including budgeting apps and basic financial calculators. While some premium tools offer advanced features, free options can still provide significant value for entrepreneurs starting out.

How do I choose the right financial planning tool for my business?

To choose the right financial planning tool, assess your business needs, consider your financial goals, and explore features like ease of use, integration options, and scalability. A good match will support your unique entrepreneurial journey.

Can financial planning tools help with debt management?

Absolutely! Many financial planning tools, such as debt repayment calculators and budgeting apps, are specifically designed to aid in debt management by visualizing payment plans and identifying areas to cut costs, ultimately leading to better financial health.